Anti-Money Laundering (AML) Control Officer

Website Keshless (Pty) Ltd

Position: Anti-Money Laundering (AML) Control Officer

Location: Eswatini | Employment Type: Full-time

About Keshless:

Keshless (Pty) Ltd is a rapidly growing fintech company committed to revolutionizing digital payments in Eswatini and the region. We provide innovative, secure, and efficient financial solutions to businesses and consumers, ensuring compliance with all regulatory standards while promoting financial inclusion.

Position Summary:

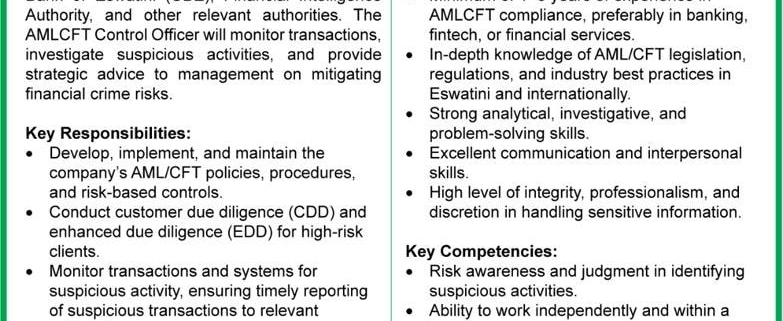

The Anti-Money Laundering (AML) Control Officer will be responsible for developing, implementing, and maintaining Keshless’ AML and counter-terrorist financing (CTF) frameworks. This role ensures compliance with the regulatory obligations set by the Central Bank of Eswatini (CBE), Financial Intelligence Authority, and other relevant authorities. The AMLCFT Control Officer will monitor transactions, investigate suspicious activities, and provide strategic advice to management on mitigating financial crime risks.

Key Responsibilities:

-

Develop, implement, and maintain the company’s AML/CFT policies, procedures, and risk-based controls.

-

Conduct customer due diligence (CDD) and enhanced due diligence (EDD) for high-risk clients.

-

Monitor transactions and systems for suspicious activity, ensuring timely reporting of suspicious transactions to relevant authorities.

-

Maintain accurate records of AML/CFT-related activities and prepare regular compliance reports for management and regulators.

-

Provide AML training and awareness programs for employees across the company.

-

Keep abreast of local and international AML/CFT regulations, guidance, and best practices, ensuring compliance and proactive risk management.

-

Liaise with regulators, auditors, and law enforcement agencies as required.

-

Support the onboarding of new customers by ensuring AML compliance is embedded in the process.

-

Assist in conducting internal audits and risk assessments related to financial crime prevention.

Qualifications and Experience:

-

Bachelor’s degree in Law, Finance, Accounting, Business Administration, or related field.

-

Professional certification in AML/CFT (e.g., CAMS, ICA, CFCS) is highly desirable.

-

Minimum of 1–3 years of experience in AML/CFT compliance, preferably in banking, fintech, or financial services.

-

In-depth knowledge of AML/CFT legislation, regulations, and industry best practices in Eswatini and internationally.

-

Strong analytical, investigative, and problem-solving skills.

-

Excellent communication and interpersonal skills.

-

High level of integrity, professionalism, and discretion in handling sensitive information.

Key Competencies:

-

Risk awareness and judgment in identifying suspicious activities.

-

Ability to work independently and within a team.

-

Attention to detail and strong organizational skills.

-

Proficiency in AML monitoring systems and compliance software is an advantage.

What We Offer:

-

Competitive remuneration.

-

Opportunity to work in an innovative and fast-growing fintech environment.

-

Collaborative and dynamic work culture.

How to Apply:

Interested candidates are invited to submit their CV and a cover letter to nomcebo@sunubec.co.sz by the end of the day, 26 January 2026.

Only shortlisted candidates will be contacted.

To apply for this job email your details to nomcebo@sunubec.co.sz.